Read our latest report about booking behaviors: Tours and Travel Activities Pre-Covid (2019) and Post-Covid (2022) Comparison Report

One of the hottest segments within the tourism industry is the Tours, Attractions and Travel Activities sector. The rapid changes taking place within this sector, both in terms of supply and demand, have propelled intrigue from journalists, analysts, and market players.

TourScanner collected some of its data for an analysis, and the results revealed some fascinating, interesting information about travel trends.

The report can be read on this page or it can be downloaded as presentation in pdf format.

Purpose of the study

In this study, TourScanner aims to identify travel trends in the sector of tours and travel activities. The two sections of the report analyze:

- The market and the geographical distribution of the offering.

- The behavior of the user through the analysis of the transactions.

Methodology & Assumptions

- The study targets the sector of Tours and Travel Activities (T&A) of short duration, mainly daily activities or 2-day/3-day tours, which is the focus of TourScanner. Data regarding long multi-day tours are not taken into account in this report.

- The data within this report comes from:

- TourScanner’s catalog, when used to create the ranking of the top destinations and activities.

- One million visitors on TourScanner’s website, when used for demographics and behavior purposes.

- The analysis of 10,000 bookings made through TourScanner in 2019.

- The typical users of TourScanner come from the United States, the United Kingdom, Canada, Australia, France, Germany, Italy, and Spain. Therefore, booking behaviors apply mainly to the western side of the world and do not account for Asian travelers.

Market and Catalog

Market

- The market of Tours & Travel Activities includes all of the activities that travelers do while on vacation, which excludes transportation, accommodation, and meals. It encompasses all of the sightseeing activities, attractions, museums, outdoor, food experiences, day trips, shows, and wellness.

- According to Phocuswright , Skift and Eyes for Travel, the total market of T&A is worth between US$150B and US$200B and it is growing at about 9% per year, making it the third-largest travel segment after flights and hotels.

- According to Phocuswright and Arival, the percentage of bookings made online still sit below 30% but continues to grow at a rapid rate.

- In the last few years, there have been many companies that have improved the back-end technologies behind this sector, providing leeway for instant pricing, availability, booking, and confirmation.

Relevant Players

- The growth of the market and the shift from offline to online bookings have attracted startups and classic OTAs to the travel market segment.

- Few startups have raised a large amount of funding, and currently, Get Your Guide ($654M) and Klook ($521M) have been the most successful.

- There have been important acquisitions in the sector, starting with the buyout of Viator by Tripadvisor in 2014, the exit of Musement to TUI (2018), and the acquisition of FareHarbor by Booking (2018).

- Airbnb entered the market in 2016 with Experiences.

- General travel OTAs, such as Expedia and Traveloka, are also active in the sector. Booking, after the acquisition of Fareharbor, has recently opened its marketplace for tours and activities.

- Besides the most known brands, there is a long tail of medium and small size OTAs that specialize in tours and activities. TourScanner has tracked over 100 online platforms selling tours and activities online. Click here to download the full list.

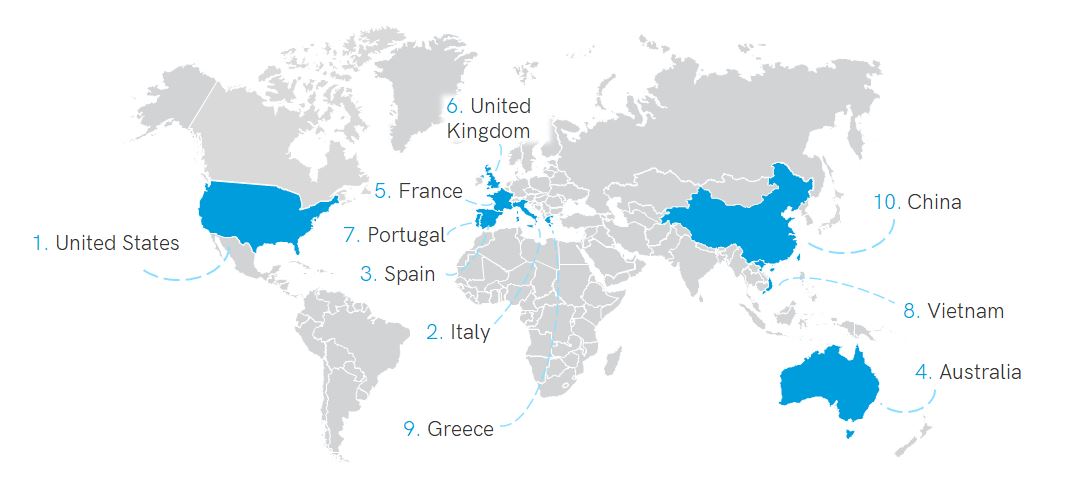

Top 10 Countries

The countries with the highest number of activities are the most touristic countries, with the United States at the top, followed by popular European travel destinations (Italy, Spain, France, United Kingdom, Portugal, and Greece). Australia, thanks to its array of outdoor activities, also received a high ranking. Vietnam and China have earned the top ranking for Asian countries.

Top 10 Destinations

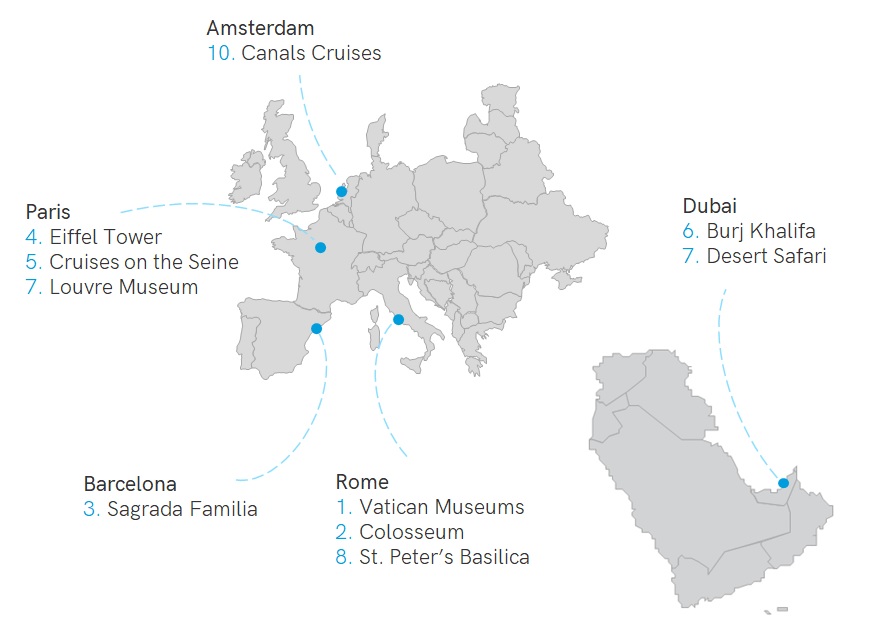

Europe accounts for 7 cities out of 10, while New York City is the only American destination; Dubai and Bali are the destinations with the widest catalog.

Top 10 Attractions & Activities

- The most booked activities are related to city sightseeing and visiting world-famous attractions and museums.

- Europe currently dominates the top position, with three of the most touristic cities (Rome, Barcelona, and Paris) sitting at the top of the prestigious list.

- Dubai is the only extra European destination.

Customer behavior and booking analysis

Customers

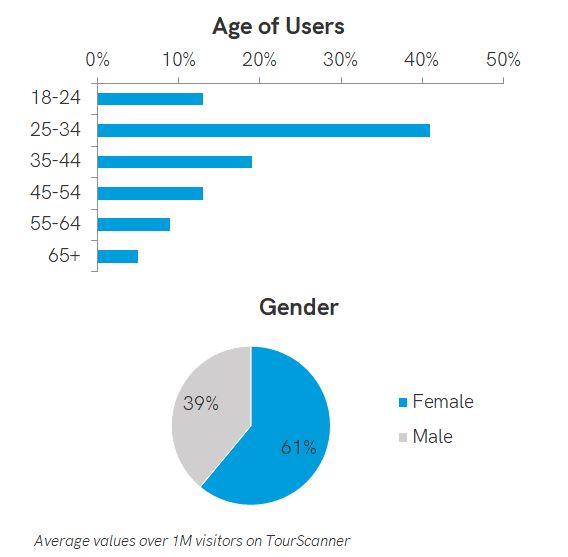

- Travelers looking for tours and activities online are millennials, aged between 25 and 44 years old.

- The interest in tours and activities is slightly higher among females.

Devices

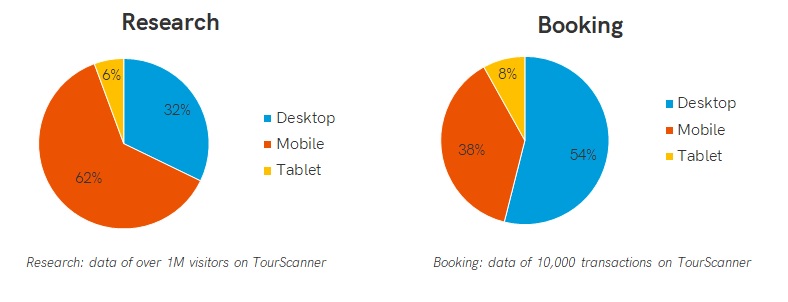

- Smartphones have become the predominant device to research information about an upcoming trip, with 62% of usage on TourScanner.

- Similar values were reported by TripAdvisor and Trekksoft.

- Concerning bookings, on TourScanner, travelers prefer to use desktop devices (54%), but the percentage of mobile bookings remains relevant (38%).

- Data from other publications report a higher value for mobile bookings. In particular:

- In 2018, Trekksoft saw 57% of its online bookings processed via mobile, but 73% of the revenue was made through desktop.

- Get Your Guide, in 2017, was expecting more than 50% of bookings to be mobile-driven.

- In 2018, Klook accounted for more than 75% of total bookings from mobile devices. The data of Klook deviates from the previous ones since Chinese consumers are used to booking on mobile devices compared to American and European customers (the majority of the customer base on TourScanner).

When do travelers book activities?

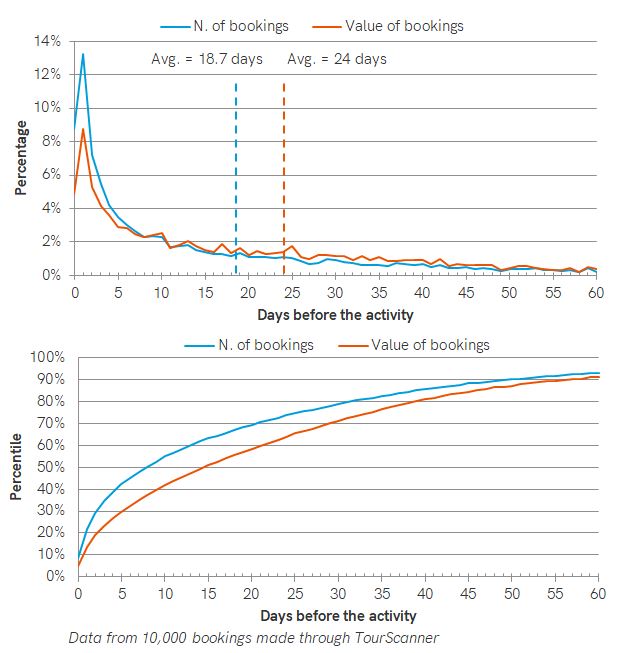

- The first graph reports the statistical distribution of the bookings over the number of days left before the day of consumption of the activity. The value zero means that the activity is booked on the same day of consumption.

- The blue line corresponds to the distribution of the number of bookings, while the orange line plots the distribution of the bookings weighted by the price of the activity.

- The comparison between the two curves demonstrates that the value of the activities booked closer to the day of the consumption tends to be lower than the ones booked more in advance (see next slides).

- The second graph reports the percentile distribution of the bookings. It shows that 50% of the activities are booked less than 8 days before the consumption, while 50% of their value is reserved less than 2 weeks in advance.

- Eyes for Travel reported that around 85% of the bookings of tours and activities via global OTAs are made 48 hours or less before departure, while Google’s study claims that 48% of bookings are happening when travelers are already in destination. Phocuswright reported that 38% of bookings happen up to 2 days before the trip.

- It is important to consider that the data from TourScanner accounts for the date of consumption of the activities and not the date of arrival in destination.

Booking behavior by device

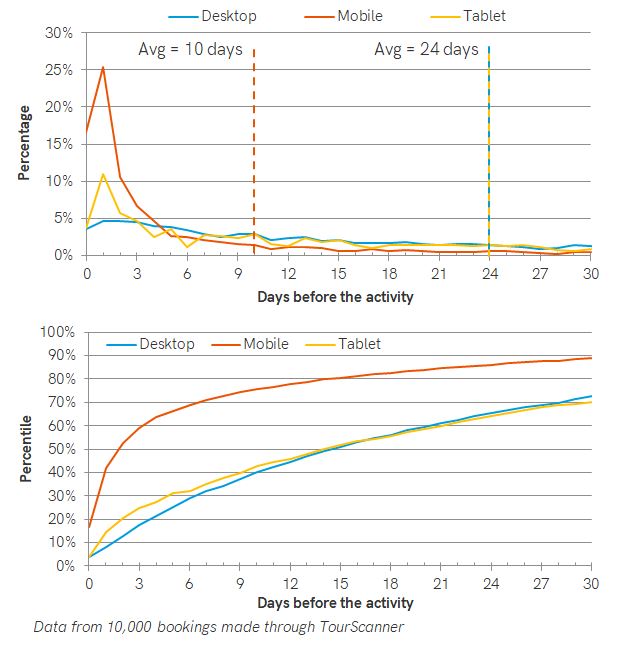

- The graphs report the percentage and percentile distribution of the bookings divided by device. It is evident that smartphones are used in-destination for last-minute bookings while desktop is used more for bookings made in advance.

- Tablets have an hybrid behavior. There are last-minute transactions, but many customers are using tablets instead of smartphones for better user experience (larger display), when they have to book in advance or for large transactions (see next slide). The average anticipation of the booking for tablet and desktop are very similar (about 24 days).

- Over 50% of the mobile transactions happen between the day of the activity and 2 days before (probably in-destination).

How much do travelers spend?

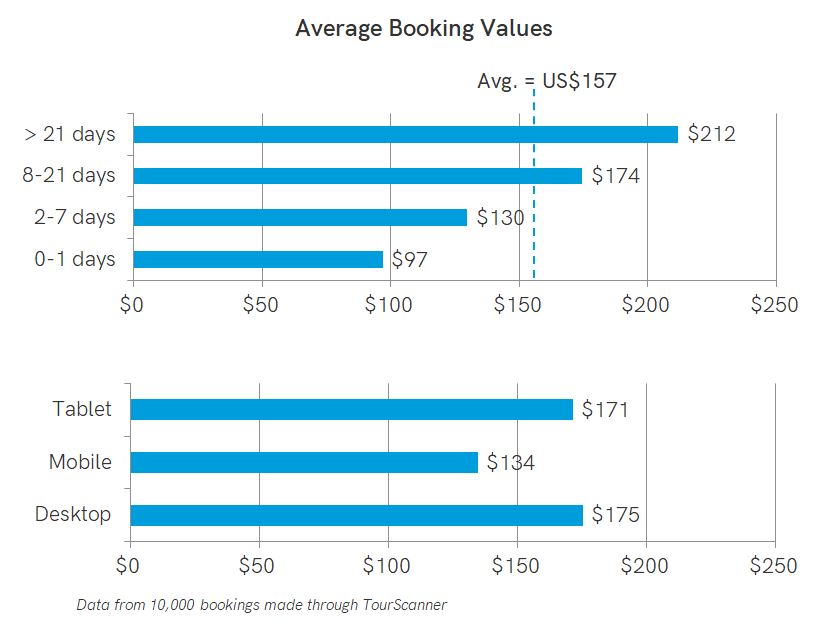

- The average booking value (US$157) is in line with claims by other players. (Get Your Guide, Eyes for travel).

- Travelers book expensive activities more in advance compared to cheaper ones (over 100% increase).

- Customers are more comfortable with booking expensive activities on desktop and tablets rather than via mobile.

Key Takeaways

- The number of players (OTAs, marketplaces, etc.) active in tours and activities, while already large, continues to increase. TourScanner has tracked over 100 websites active in this sector. Click here to download the full list.

- European destinations and world-famous attractions play the most important role in the tours and activities market.

- The typical customer is a digital millennial and females are slightly more interested than males.

- Different devices are used for different purposes by travelers. Smartphones are predominantly used for broad research and last-minute/in-destination booking, while desktop still plays an important role for advance planning and reservation of expensive tours.

- Overall, more than 50% of the reservations are made less than 8 days before the date of the activity, while, on smartphone, the 50% percentile is reached 2 days before the day of consumption. The average booking cart is slightly above US$150. Travelers tend to book expensive activities more in advance compared to cheaper activities.